Introduction

With the the European Union’s flagship crypto-assets regulation, the Markets in Crypto-Assets (MiCA) set to kick into full gear by the end of this year, crypto-asset businesses operating in the EU have been scrambling to ensure compliance with the new rules.

Some crypto-asset service providers or CASPs, such as the U.S. dollar-based stablecoin issuer Tether, may be forced to exit the EU market altogether, on concerns over challenges with MiCA compliance.

Other CASPs have taken advantage of market gaps, and issued their own stablecoins, in accordance with MiCA’s regulatory regime.

In this case study, we examine transaction activity of one of the EU’s first euro-backed stablecoins EURI, explore the compliance challenges, and discuss whether more comprehensive transaction monitoring is needed for MiCA-compliant stablecoin issuances.

For the purposes of this discussion, the more commonly understood term “stablecoin” shall be used to refer to MiCA’s “e-money tokens.” However, it is important to note that the official terminology for “stablecoin” according to MiCA, is “e-money token.”

What is Eurite (EURI)?

Banking Circle S.A., a Luxemborg-based company, issues the Eurite (EURI) stablecoin, backed by the euro, and regulated under MiCA.

According to Eurite’s website,

Eurite (EURI) is regulated by the Markets in Crypto-Assets Regulation (MiCA) in the EEA. Issued by Banking Circle S.A., EURI compliments Banking Circle’s existing payment systems. This includes efficient payment solutions, managed volatility exposure, smart contracts, out of hours settlement and treasury management. Being one of the first MiCA regulated EURO stablecoin is important as it ensures compliance with stringent EU standards, enhancing trust, credibility, and confidence for holders. Regulatory compliance with MiCA ensures consumer protection, transparency, and financial stability, reducing legal risks and promoting transparency and safety.

Banking Circle SA also articulates its onboarding process for EURI,

- Subject to successful KYC checks and completion of the onboarding process by Banking Circle S.A., a successfully onboarded institutional user (exchange, liquidity provider, or trading platform) subscribes to purchase EURI from Banking Circle S.A.

- The user can buy EURI, 1:1 by depositing Euro to Banking Circle’s bank account.

- Banking Circle mints new EURI equal to the Euro cash received and sends EURI to the institutional user’s wallet.

- The institutional user can then make EURI available to be bought, sold, stored, transferred or traded with others, 24:7.

- When EURI is returned to Banking Circle, the EURI will be burnt and the corresponding amount of Euro will be returned to the institutional user’s bank account.

Because the “institutional user” can make EURI available to be “bought, sold, stored, transferred or traded with others,” it stands to reason that who these “others” are may be of interest to regulators.

Who are Eurite’s partners?

According to Eurite’s white paper at page 16, the details of the parties involved in the implantation of the crypto-asset project include crypto-asset exchanges “such as Binance France SAS.”

Other parties involved include “StableMint Labs Pte. Ltd.” (“StableMint”) a Singapore-based company, although the white paper makes no further mention of StableMint anywhere else.

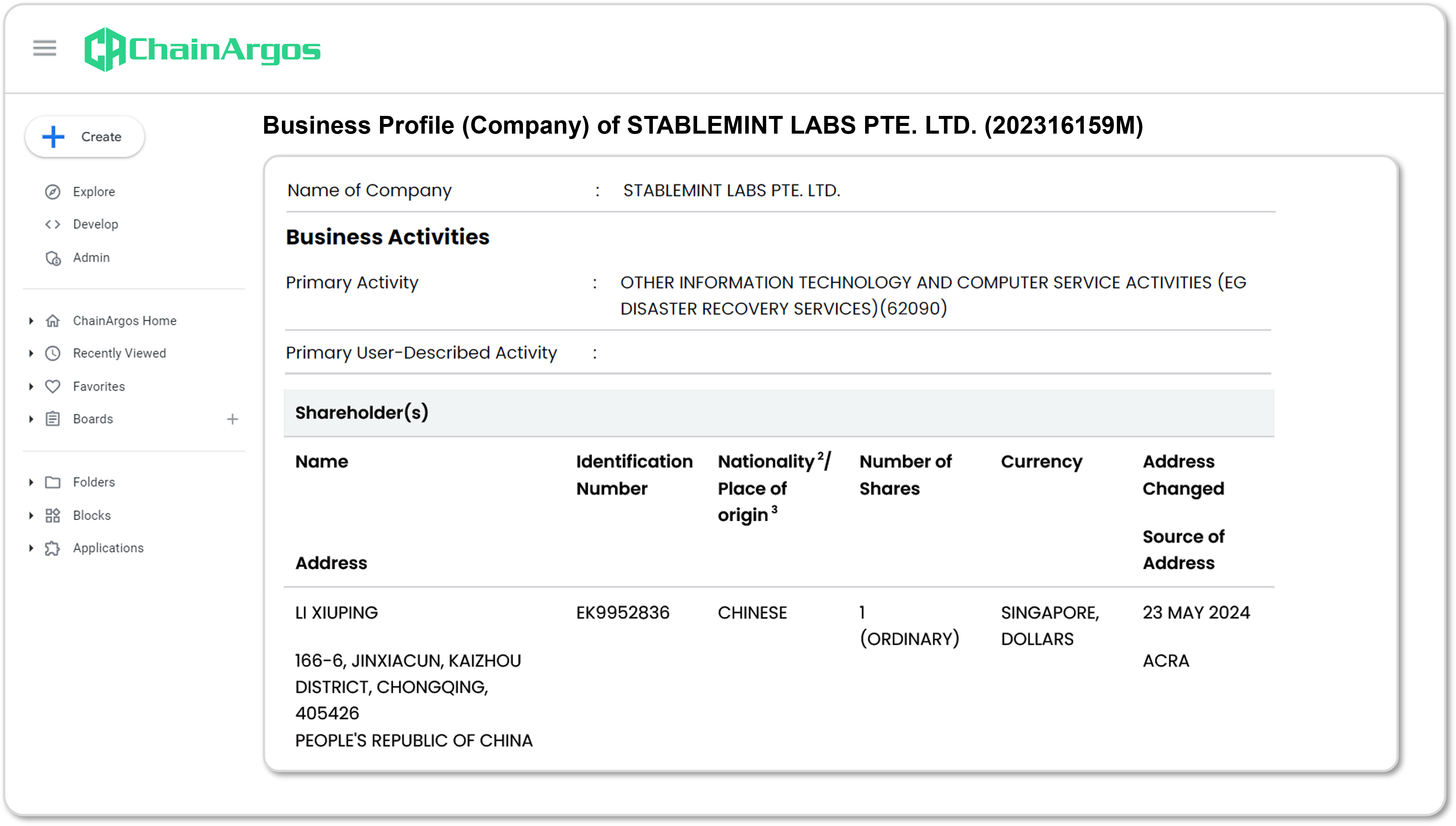

It is unclear what role StableMint plays in the issuance of the EURI stablecoin, but a further investigation reveals that the company has an issued and paid-up share capital of one Singapore dollar (US$0.77).

StableMint’s sole shareholder, who also serves as one of two directors of the company, is a Chinese national by the name of Li Xiuping and the company’s primary business activity is listed as “other information technology and computer service activities.”

Beyond this information, little, if any is known about the role StableMint plays in the EURI stablecoin, but whatever that role is, it must have been thought significant enough for StableMint to be listed in the EURI white paper.

Figure 1. Excerpt of Business Profile of StableMint Pte. Ltd. obtained from Singapore’s business registry Bizfile and extracted on October 5, 2024.

Who has been using EURI?

EURI is issued on two blockchains, the Ethereum blockchain and the BNB Smart Chain (“BSC”) which right off the bat should provide some clues as to who the likely users are for EURI.

The Top Senders of EURI

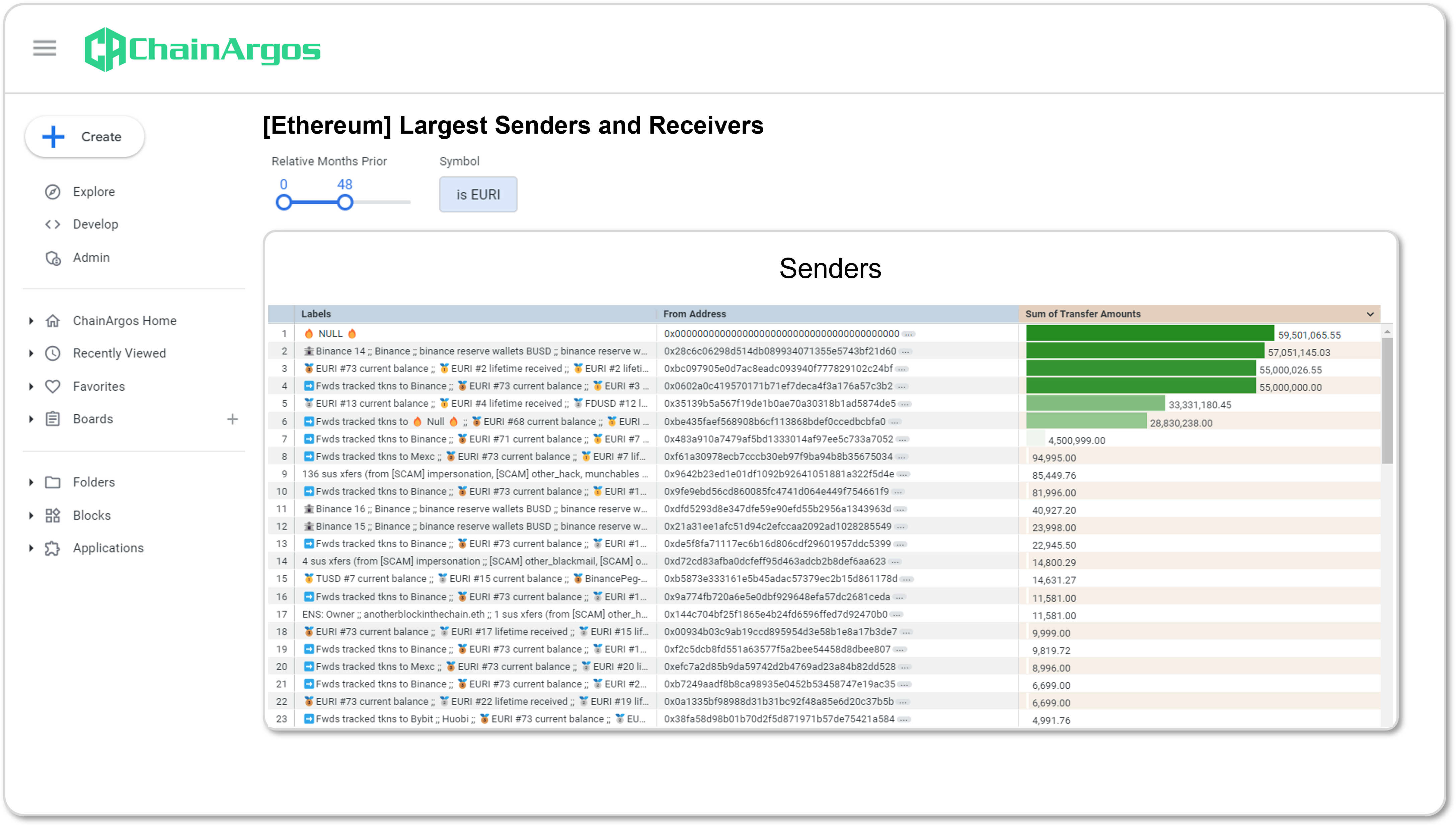

Of the top ten senders of EURI, most appear to be associated with Binance, with the exception of 0x35139b5a567f19de1b0ae70a30318b1ad5874de5 (“0x351 Address”) which stands out because it is the fifth largest sender of EURI.

Figure 2. Largest Senders of EURI on the Ethereum blockchain over the past 48 months.

The 0x351 Address is not just the largest sender of EURI, it is also the most active address for EURI on the Ethereum blockchain, and responsible for substantially all (well over 99.99%) of the EURI which was burned and presumably redeemed for euros.

The Top Receivers of EURI

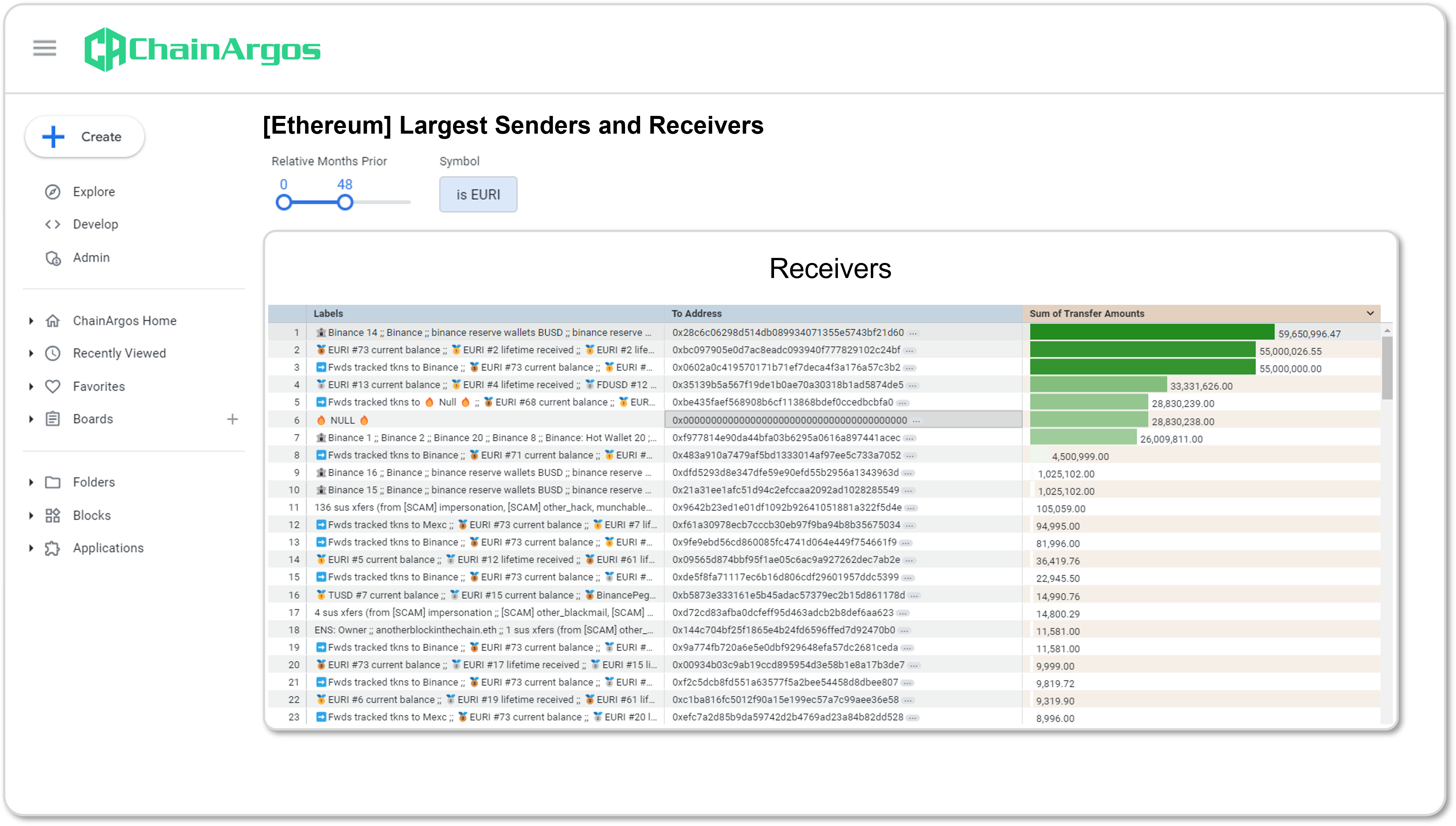

The 0x351 Address sent 28,830,181.45 EURI to the NULL Forwarding Address, or substantially all of the redemption of EURI for euros on the Ethereum blockchain as observed in Figure 3 and Figure 4.

At the time this report was prepared, there was no burning of EURI on the BSC blockchain.

Figure 3. Largest Receivers of EURI on the Ethereum blockchain over the past 48 months.

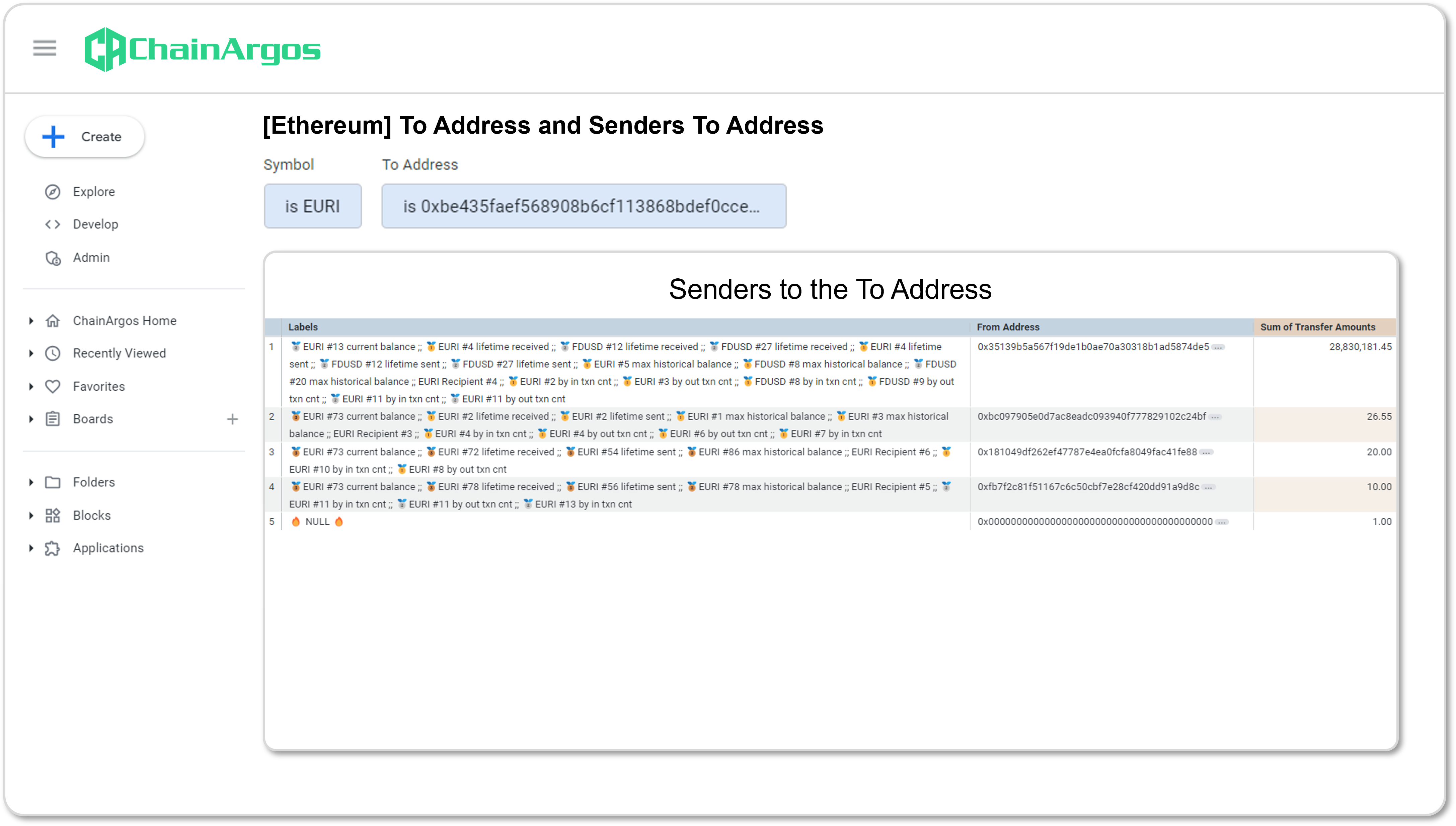

Redemption of EURI for euros is processed via the address 0xbe435faef568908b6cf113868bdef0ccedbcbfa0 (“NULL Forwarding Address”) as shown in Figure 4.

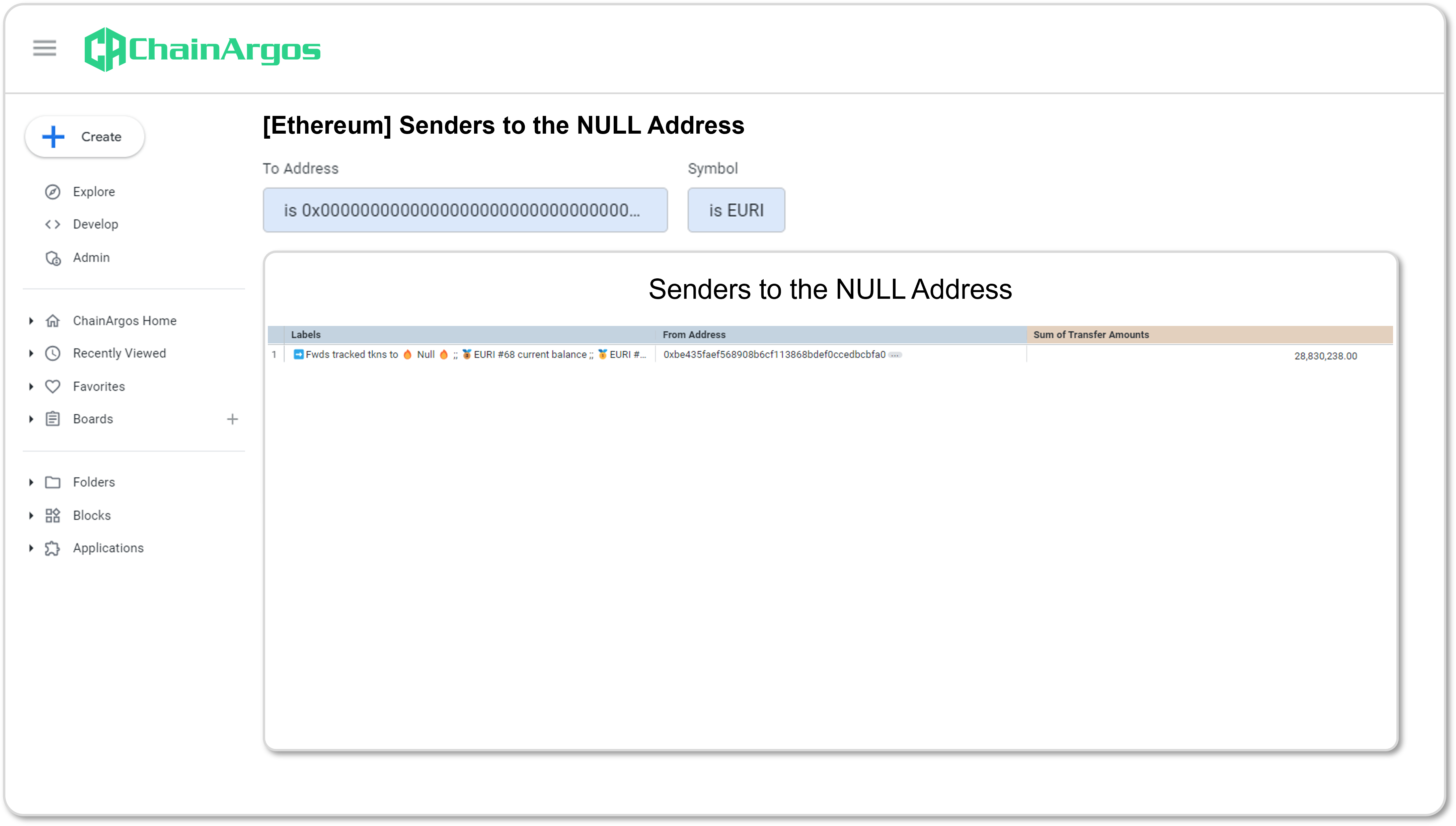

Figure 4. Senders of EURI to the NULL Forwarding Address.

The NULL Forwarding Address in turn sent 28,830,238.00 to the NULL address as seen in Figure 5.

Figure 5. Senders of EURI to the NULL Address.

The 0x351 Address constituted well over 99.99% of the amount of EURI that the NULL Forwarding Address sent to the NULL address.

Given that the 0x351 Address is a major user of EURI, and the only counterparty that appears to have redeemed EURI for euros, it would be worthwhile to understand who the biggest user of EURI is by examining their transaction activity.

What does the 0x351 Address do on the Ethereum blockchain?

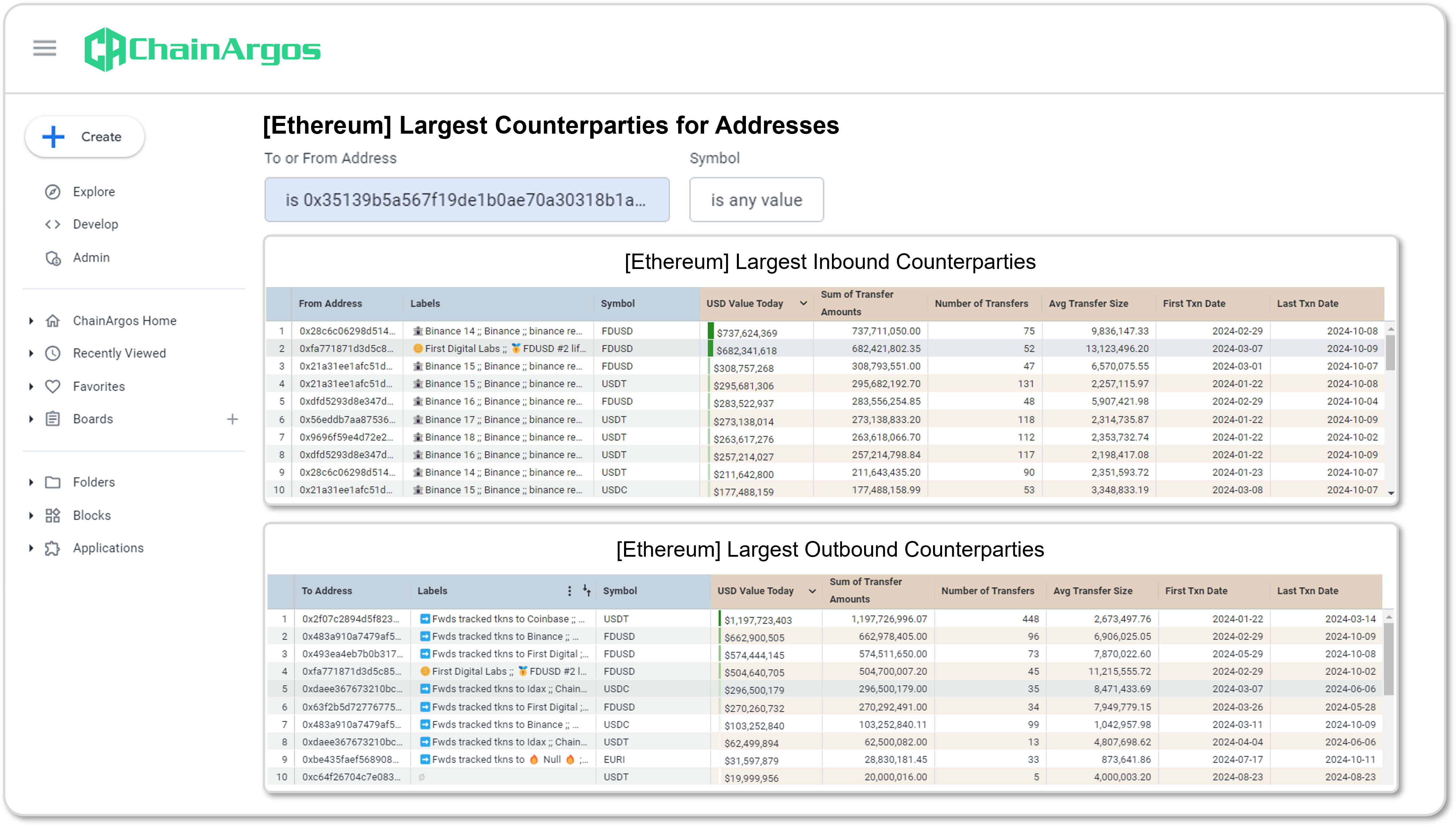

The 0x51 Address is a very heavy user of the US dollar-based stablecoin FDUSD on the Ethereum blockchain, having received just over 2 billion FDUSD from Binance and First Digital, and sending essentially all the FDUSD it receives to Binance and First Digital.

Figure 6. Largest Inbound and Outbound Counterparties for the 0x351 Address on the Ethereum blockchain.

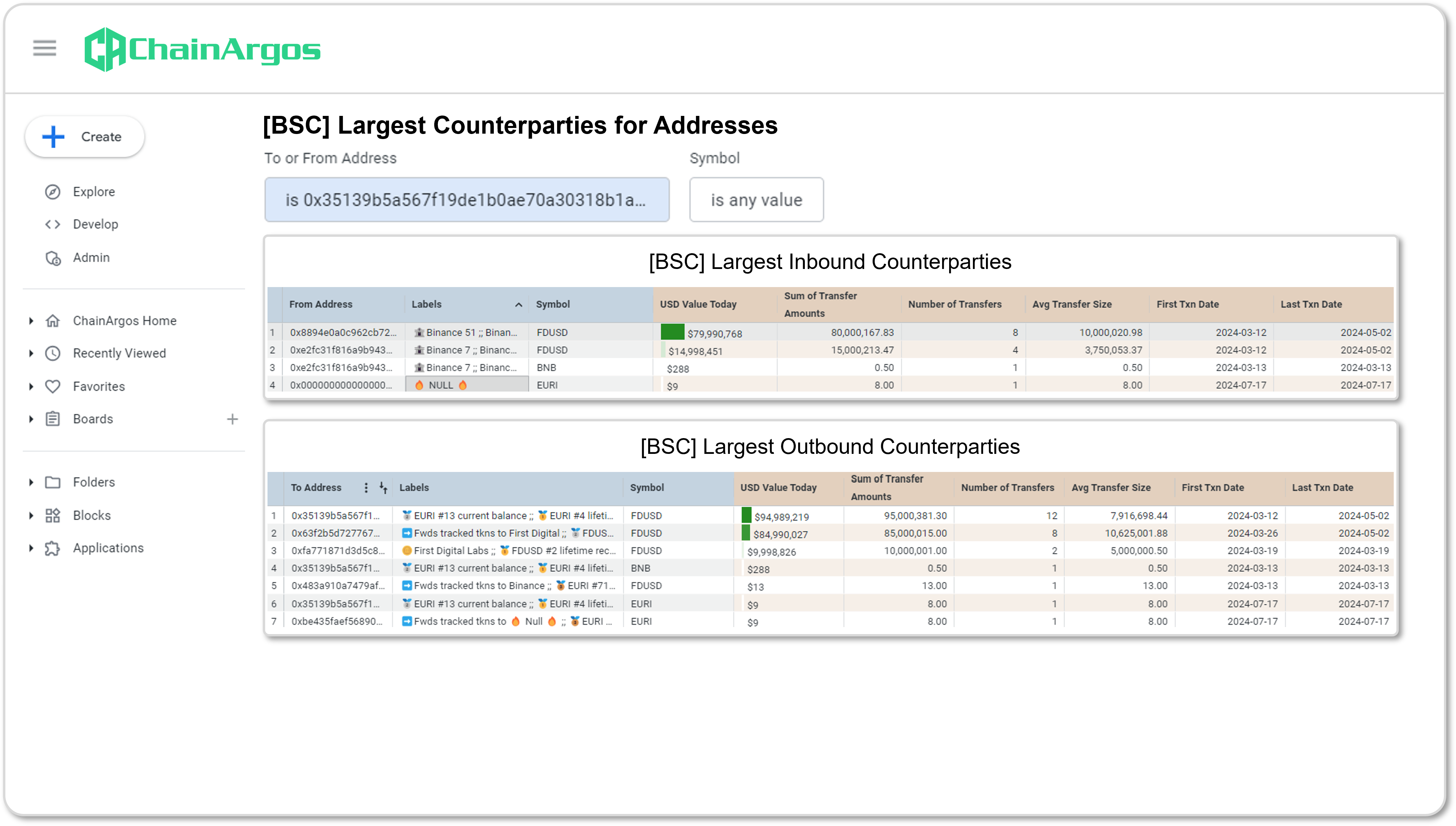

What does the 0x351 Address do on the BSC blockchain?

On the BSC blockchain, the 0x351 Address appears to play the role of some sort of over-the-counter broker as well, receiving around 95 million FDUSD from Binance, and sending all 95 million of that FDUSD onwards to First Digital.

Figure 7. Largest Inbound and Outbound Counterparties for the 0x351 Address on the BSC blockchain.

What is FDUSD?

FDUSD is the ideological and functional successor to crypto-asset exchange Binance’s BUSD stablecoin product on the BSC blockchain.

Paxos Trust LLC, a New York-licensed trust company, was approved to issue the BUSD stablecoin, a US dollar-backed stablecoin on the Ethereum blockchain.

However, Paxos Trust LLC’s partner, the crypto-asset exchange Binance was also minting a “wrapped version” of the BUSD stablecoin on the BSC blockchain.

The BUSD stablecoin on the BSC blockchain was not a regulated product, but was intended to have been backed by BUSD on the Ethereum blockchain before being minted.

In January 2023, Binance was revealed by ChainArgos to have issued as much as $1.4 billion worth of unbacked BUSD on its BSC blockchain.

By February 2023, the New York Department of Financial Services ordered Paxos Trust LLC, issuer of the BUSD stablecoin on the Ethereum blockchain, to stop minting BUSD for failing to properly supervise its relationship with its partner Binance.

Because the writing was on the wall for the BUSD stablecoin and with the market cap for BUSD in rapid decline, presumably a replacement for Binance’s coin of the realm was needed.

Enter FDUSD.

By June 2023, FDUSD, the functional successor to Binance’s doomed BUSD stablecoin had been launched and that very same month, Binance offered zero-fee trading pairs for FDUSD on their crypto-asset exchange supposedly to encourage use of FDUSD.

What does the transaction activity for the 0x351 Address reveal?

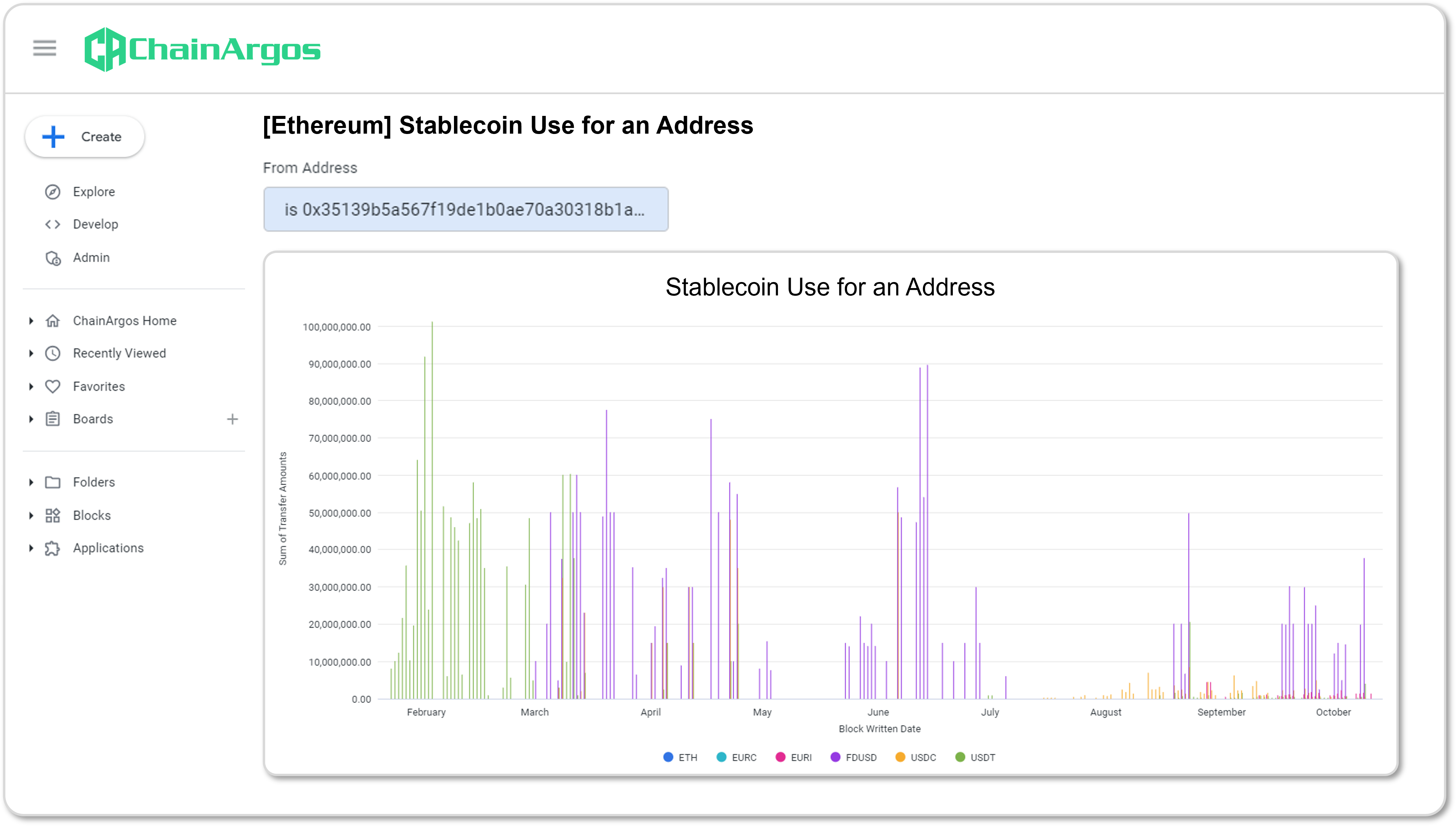

The 0x351 Address appears to have gone through some kind of regime change in its stablecoin use, possibly linked to its ability to obtain off-ramps for fiat currency based on the stablecoin in question and the crypto-asset exchanges it had access to.

Looking at the chart below in Figure 8, the 0x351 Address transacted primarily in Tether’s US dollar-based stablecoin USDT from January to March of 2024, represented by the green bars.

However, the 0x351 Address saw its transaction activity change abruptly to FDUSD around March 2024, a pattern which continues generally to October 2024, as represented by the purple bars in Figure 8.

Switching “stablecoin regimes” is not new. Take stablecoin-issuer Tether’s USDT for instance, which sees transaction activity that is dramatically different between the Tron and Ethereum blockchain networks.

The sheer volume of USDT flowing through blockchain addresses “blacklisted” by Tether on the TRON blockchain network completely dwarfs the USDT volumes through the Ethereum blockchain network.

That there is more USDT flowing through blockchain addresses that are “blacklisted” by Tether on the TRON blockchain network should come as no surprise, as in general, there are far more transactions for USDT on TRON than on Ethereum.

Transaction fees are significantly lower for USDT on TRON than on Ethereum, which is why many choose to transact USDT on the TRON blockchain network, instead of Ethereum.

Regardless, the amount of USDT Tether has been able to “freeze” on different blockchain networks also differs dramatically.

On the TRON blockchain network, Tether only managed to “freeze” around 0.49% of all inbound USDT to “blacklisted” blockchain addresses, meaning a whopping 99.51% of possibly illicit USDT made it through.

Whereas Tether has had far more success “freezing” USDT on the Ethereum blockchain network, with almost 1 in 5 USDT flowing into “blacklisted” blockchain addresses successfully “frozen”.

The observations are not intended to be a criticism of Tether, but rather to highlight the difficulty involved with trying to “freeze” illicit fund flows in a permissionless environment and why regulators should be on the lookout for shifts in “stablecoin regimes.”

Figure 8. Stablecoin use for the 0x351 Address on the Ethereum blockchain.

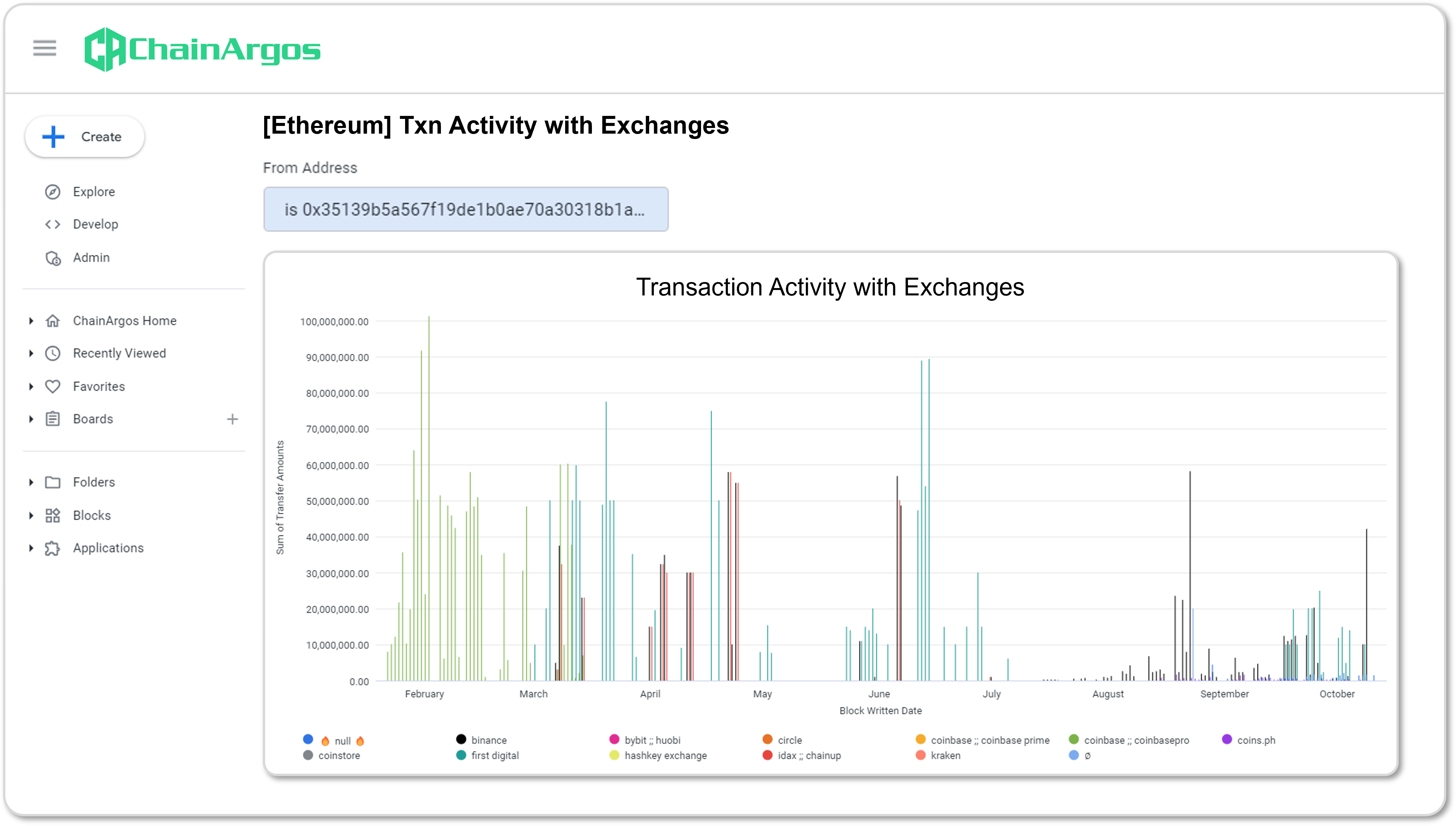

Coincidentally, the 0x351 Address also appears to have been transacting primarily with Coinbase from January to March 2024, before again abruptly swapping to deal mainly with Binance and First Digital from March 2024 onwards.

The light green bars in Figure 9. represent the transaction activity between the 0x351 Address and wallets belonging to Coinbase and Coinbase Prime. This activity proceeded in earnest until mid-March 2024 when for some reason the activity dropped off.

The teal and black bars in Figure 9. represent the transaction activity of the 0x351 Address now being taken over by First Digital Trust Limited and crypto-asset exchange Binance respectively, and continue even to October 2024.

Figure 9. Crypto-asset exchange use for the 0x351 Address on the Ethereum blockchain.

Fees for FDUSD trading pairs returned to Binance around March 2024, and if the 0x351 Address was rotating into trading crypto-assets using FDUSD, taking advantage of zero-fee trading seems unlikely to have been a major driver of the shift.

Around the same time, Circle Internet Financial, LLC was removing support for its US dollar stablecoin USDC on the TRON blockchain.

It is unclear why the 0x351 Address shifted transactions from the USDT stablecoin to FDUSD and from Coinbase to Binance and First Digital in March 2024, but this looks to be a shift consistent with needing to make new arrangements in March 2024 that may not have necessarily been driven by economic factors.

What does this all mean for EURI?

As one of the largest transactors in EURI, and what appears to be the only counterparty which has redeemed EURI for euros, Banking Circle SA must certainly know the identity of the 0x351 Address.

Based on the transaction activity of the 0x351 Address on other blockchains and in other crypto-assets, in particular the FDUSD stablecoin, it is likely the 0x351 Address has a relationship with Binance and First Digital Trust Limited.

First Digital Trust Limited is a Hong Kong trust entity and is alleged to have provided the “risky Commodity Fund” listed in the U.S. Securities and Exchange Commission’s complaint against TrustToken and TrueCoin.

According to news reports, First Digital Trust Limited provided this “risky Commodity Fund” to back over 99% of the assets backing the TUSD stablecoin, meaning there could have been the risk the TUSD stablecoin was not adequately backed at all material times.

The 0x351 Address and its transactions should provide regulators plenty of food for thought given EURI is one of the “first MiCA regulated EURO stablecoin(s)” and an “institutional user can then make EURI available” for use by others.

Based on transaction data for the 0x351 Address, it is highly likely the 0x351 Address is an “institutional user” for EURI.

If the bulk of transactions for the 0x351 Address involve FDUSD, Binance, and First Digital, surely one question has to be whether EURI is being used as an euro off-ramp for FDUSD or other stablecoins.

Is the 0x351 Address associated with or belonging to Binance and First Digital, and if so, who is providing the requisite due diligence for the 0x351 Address’s customers?

Can we do better?

The requirement to ascertain beneficial ownership for stablecoins under MiCA originates from various international standards and regulations, including:

- Fourth Anti-Money Laundering Directive (AMLD4): This EU directive established the obligation for financial institutions to identify and verify the beneficial ownership of their customers.

- Financial Action Task Force (FATF): The FATF, an intergovernmental body, has issued recommendations that require countries to implement measures to prevent money laundering and terrorist financing, including the identification of beneficial owners.

- International Organization of Securities Commissions (IOSCO): IOSCO has issued principles that encourage securities regulators to adopt measures to prevent money laundering and terrorist financing, which often include beneficial ownership requirements.

These standards and regulations aim to address the concerns of money laundering and terrorist financing, which can be facilitated by anonymous ownership structures.

By requiring the identification of beneficial owners, regulators can better track the flow of funds and detect suspicious activity.

But where the obligation to ascertain beneficial ownership of MiCA-compliant stablecoins like EURI ends is unclear.

Banking Circle SA certainly has an obligation to perform due diligence on customers it has a direct relationship with, such as the 0x351 Address (if that blockchain address is indeed a discrete customer).

But whether or not that duty extends to customers of the 0x351 Address seems unclear, and there are reasonable arguments to both limit and extend such obligations.

Requiring stablecoin issuers such as Banking Circle SA to vet the ultimate beneficial owner of every EURI transaction would be onerous, limiting the stablecoin’s throughput, and possibly undermining the raison d’etre of using blockchain technology to begin with.

Yet not requiring a stablecoin issuer to have at least some visibility into who its customers are dealing with does not appear to be an entirely satisfactory compromise either, as such a gap risks the stablecoin issuer’s direct customer performing the role of a money mule.

Empirical evidence, especially with respect to the blacklisting track record of stablecoin issuers in other jurisdictions, has demonstrated the risks associated with limiting a stablecoin issuer’s responsibilities to that of their immediate customers, and no further.

A stablecoin issuer operates akin to a central bank, issuing their own currency and few, if any, would argue a central bank ought to perform due diligence on every single beneficiary of the currency it issues, so why should a stablecoin issuer?

But such an argument falsely equates the essential role a central bank serves – issuing a national currency to serve the economic good of a country, with the role of private stablecoin issuers.

The bigger question is whether there are adequate tools for oversight and a compliance framework which ensures any unintended harm caused by stablecoins does not outweigh any contribution to society.